Wellington Mortgage Default

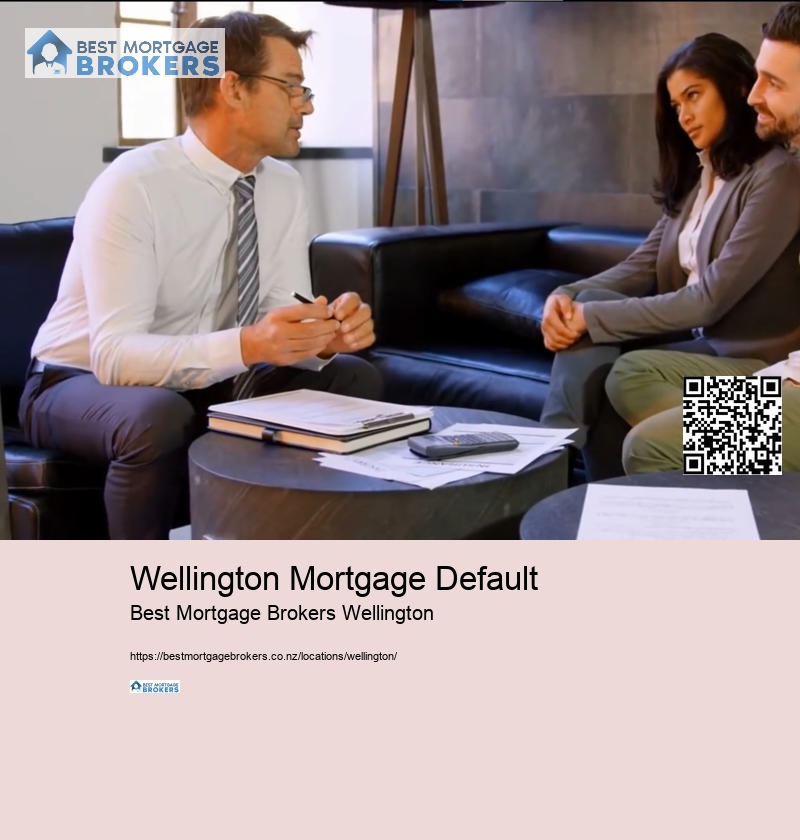

mortgage advice

Some loans may offer features like the ability to make extra payments or adjust the payment schedule, providing us with greater control over our finances. Evaluating these options allows us to tailor the mortgage to our individual needs and preferences.

Wellington Mortgage Default - property management

- financial strategies

- financial analysis

- first-time homebuyer

- new home

- debt consolidation

- financial expertise

- financial consulting

- advisor

- financial planning process

- investment property

By comparing offers from trustworthy lenders, we can feel confident in our choice and move forward with securing the mortgage that's right for us. To maximize the benefits of our mortgage offers, exploring the potential advantages of refinancing can be a strategic move towards optimizing our financial situation.

First and foremost, refinancing can lead to lower monthly payments by securing a new loan with a lower interest rate than your current mortgage. This reduction in interest rates can translate to substantial savings over the life of the loan.

This can be particularly advantageous in times of economic uncertainty when interest rates are expected to rise. Moreover, refinancing can enable you to shorten the term of your loan, allowing you to pay off your mortgage sooner and potentially save thousands of dollars in interest payments.